1. Macroeconomic and Geopolitical Context

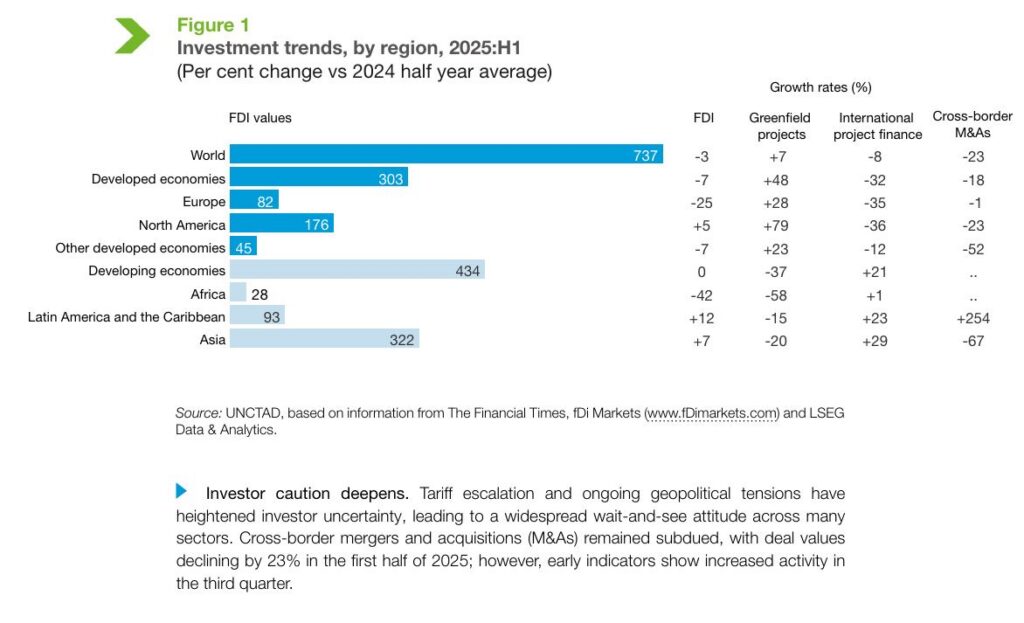

According to UNCTAD (Global Investment Trends Monitor No. 49, October 2025), global Foreign Direct Investment (FDI) flows declined by 3% in the first half of 2025, marking a second consecutive year of contraction.

This decline was particularly pronounced in Africa (–42%) and Europe (–25%), while Asia (+7%), Latin America & the Caribbean (+12%), and North America (+5%) recorded increases over the same period.

However, new project announcements grew by 7%, driven primarily by developed economies (+48%), especially North America (+79%) and Europe (+48%).

This trend was negative in developing economies (–37%), with sharper declines in Africa (–58%) and Asia (–20%).

Cross‑border M&A activity fell by 23% in value, despite a 24% increase in the number of deals.

The decline was particularly severe in Asia (–67%), contrasted by a spectacular surge in Latin America & the Caribbean (+254%), and relative resilience in Europe (–1%).

These shifts reflect a cautious global environment shaped by geopolitical fragmentation, supply‑chain reorganization, and increasing selectivity among institutional investors.

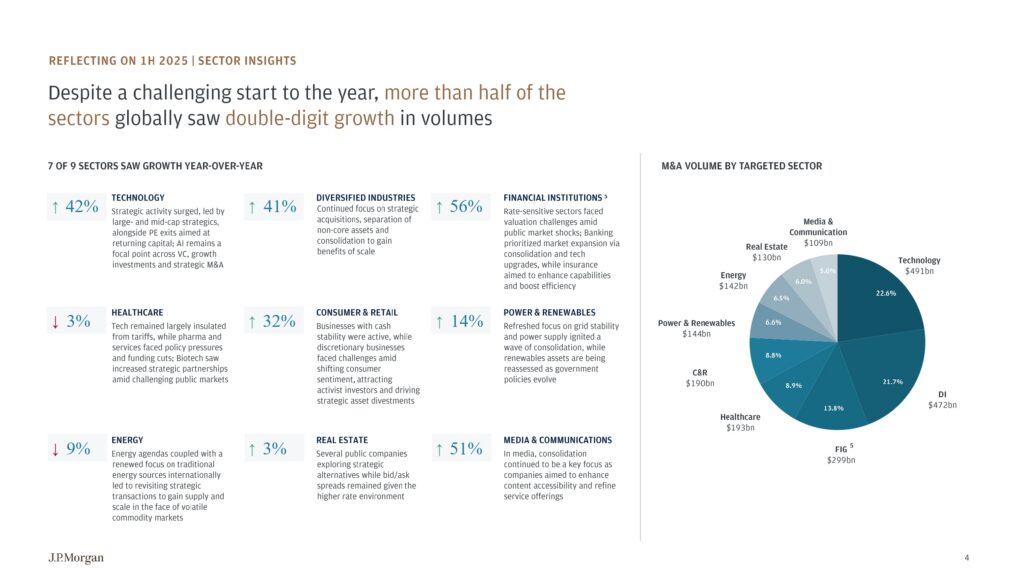

2. A Selective Recovery in Global M&A

In contrast to the macroeconomic caution, J.P. Morgan (Global M&A Annual Outlook 2025, Mid‑Year Outlook 2025) and XBMA (Q3 2025 Global M&A Report) confirm a selective yet robust rebound in global M&A activity:

- $2 trillion in announced transactions in H1 2025 (+27% vs H1 2024).

- Strong rebound in mega‑deals (> $10bn): +57% in number.

- Global M&A volume reached $1.1 trillion in Q3 2025, a 13% increase compared to Q2 ($972bn).

- In Q3 2025, the technology sector led all industries with $241bn, representing 21% of global deal volume. Over the past twelve months, tech transactions totaled $719bn, or 19% of global M&A.

- In North America, Q3 2025 M&A volume reached $619bn, up 34% from Q2 ($463bn) and 51% above the ten‑quarter average ($410bn).

- +11% growth in M&A activity in EMEA.

- 2025 full‑year projection: $4.1 trillion, or +28% vs 2024 (source: XBMA).

- Key sectors: technology, healthcare, financial services, energy.

This momentum reflects renewed CEO confidence, improved financing conditions, and a gradual normalization of valuations.

3. Sponsors, Private Equity, and Deal Structuring

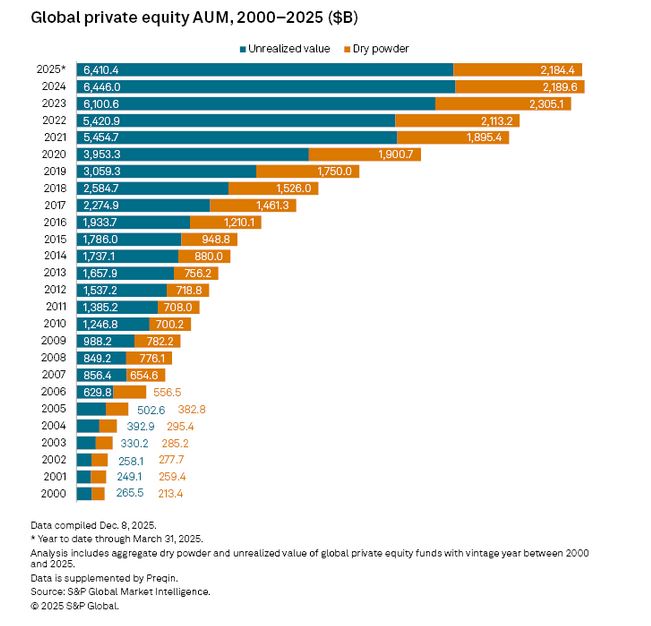

Financial sponsors are returning actively to the market, supported by:

- high levels of dry powder,

- more attractive valuation levels,

- a backlog of exits accumulated since 2022–2023,

- a gradual easing of interest rates.

Sponsored transactions — LBOs, MBOs, take‑privates, club deals — are driving the recovery.

They respond to growing investor demand for:

- strengthened governance,

- enhanced transparency,

- more rigorous strategic steering,

- value‑creation trajectories anchored in operational transformation.

4. Advantages of the Club‑Deal Model for LPs

In this environment, club deals and investor consortiums are emerging as a preferred tool for LPs and professional investors.

They offer three major advantages:

- Greater control, through reinforced governance and direct influence over strategic decisions.

- Risk sharing among multiple co‑investors, while maintaining strong alignment of interests.

- Superior flexibility in structuring, holding periods, and exit strategies.

This model is particularly well‑suited to mid‑cap transactions, where value creation relies on operational transformation, financial structuring, and strategic discipline.

5. LP Opportunity – The Sponsored Mid‑Cap Segment

The 2025–2026 outlook points to a more selective and disciplined M&A recovery cycle, in which mid‑cap acquisition transactions — LBO/MBO, family successions, sector consolidations — will increasingly be structured around:

- governance,

- transparency,

- strategic steering,

- monitoring and evaluation,

- operational value creation.

This segment combines market depth, operational complexity, and transformation potential, making it a privileged field for LPs seeking durable performance and strategic influence.

6. Positioning of Stéphane MBATEU Office

In this context, Stéphane MBATEU Office positions itself as a platform dedicated to the structuring and strategic steering of acquisition operations, designed to work closely with:

- professional investors,

- co‑investors,

- institutional LPs.

The Three Pillars of the Cabinet’s Positioning

1. Strategic Governance & Value Creation

The Cabinet structures and steers the governance of acquisition operations to ensure strong alignment between investors, management teams, and stakeholders.

This pillar is built on rigorous strategic discipline, clear role articulation, and the ability to guide key decisions. It aims to secure and accelerate the value‑creation trajectory by integrating performance, transformation, and risk‑management considerations. It ensures that strategy, incentives, and governance mechanisms converge toward a durable and controlled value‑creation path.

2. Transparency & Process Definition/Improvement

Stephane MBATEU Office implements clear, auditable, and reproducible processes covering reporting, information flows, decision‑making structures, and the formalization of operational practices.

This pillar guarantees full transparency for investors, reduces uncertainty, and strengthens the reliability of analyses and arbitrages. It is anchored in a logic of continuous improvement and organizational professionalization.

3. Monitoring‑Evaluation & Operational Steering

The Cabinet ensures a structured monitoring‑evaluation framework based on performance indicators, regular strategic reviews, and close operational steering.

This pillar enables rapid identification of deviations, timely trajectory adjustments, and hands‑on support to management teams in implementing transformation levers. It forms the foundation of durable and measurable value creation.

We therefore work to meet LP expectations in a cycle where discipline, selectivity, and operational transformation are becoming the essential drivers of performance.

Paris La Défense, 30 December 2025

Stephane MBATEU Office

Consulting Firm in Finance, International Mobility & Trading

S.A.S. with a share capital of €12,000 – RCS Nanterre 891 554 156

Headquaters : 1–7 Cours Valmy, 92800 Puteaux – La Défense

Phone: +33 (0)1 85 65 81 96 ; +33 (0)6 10 86 48 36 ; +237 6 72 44 20 89

Address: 1–7 Cours Valmy, 92800 Puteaux, Paris‑La Défense, France.